Depending on the amount of the allowance that increases the employees income this may. Capital allowances specifically are capital purchases like the acquisition of land and building that can be claimed.

Everything You Need To Know About Running Payroll In Malaysia

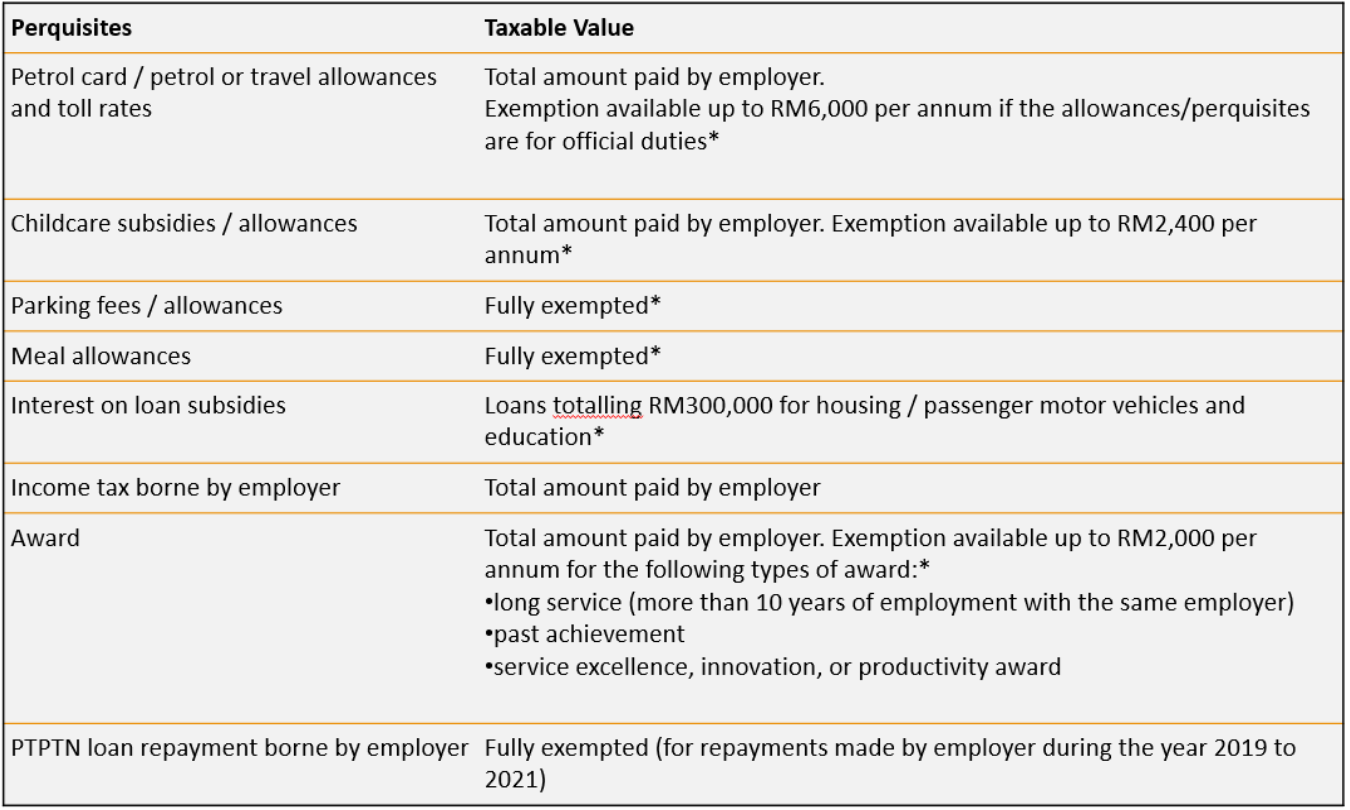

Just like Benefits-in-Kind Perquisites are taxable from employment income.

. Please note Benefits below Cash remuneration eB. Travelling allowance petrol allowance toll rate up to RM6000. Salary bonus allowancesbenefits 2.

Is Allowance Taxable in Malaysia. Salary bonus allowances perquisites. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee.

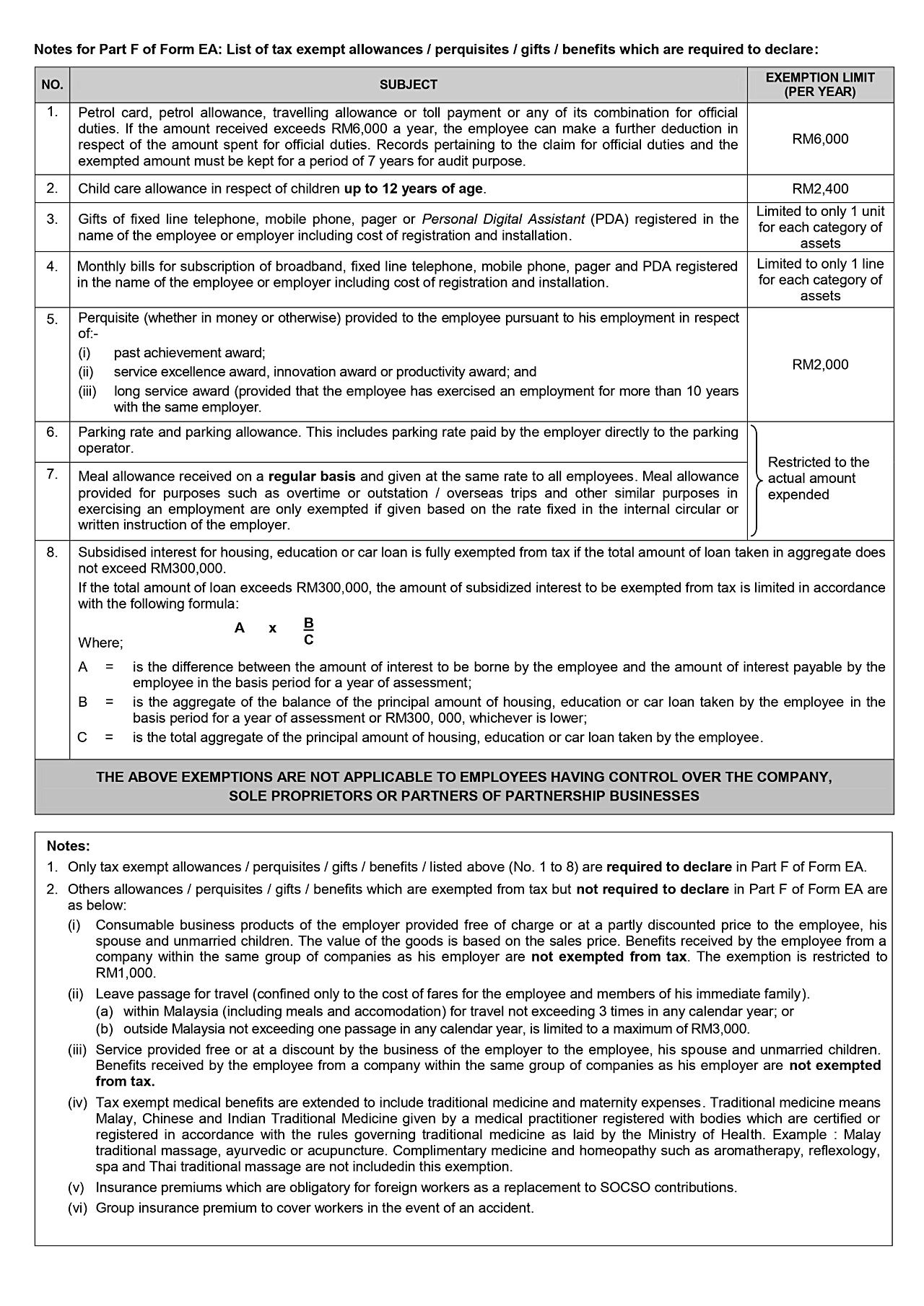

Subsidized interest on loans for education housing or motor vehicles is fully exempt from tax if the total amount of the loan taken out does not exceed RM300000. Personal income tax rates. Expatriates working in Malaysia also.

Here are the 14 tax. The Overseas Cost of Living Allowance COLA is a non-taxable allowance designed to offset the higher overseas prices of non-housing goods and services. Is Housing Allowance Taxable in Malaysia Almahuar.

Otherwise the assessed value of the accommodation service is the VA of the property minus the total. In Malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company. However the reimbursement of moving allowances is not taxable while moving allowance for unsubstantiated expenses is taxable.

Meal allowance is paid according to the position duties or place where the employment is performed by the employee. An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia. It affects approximately 250000.

Only tax exempt allowances perquisites gifts benefits listed above No. Cash remuneration eB. Llamanos al 011 6219-7685.

Tax tables in Malaysia are simply a list of the relevent tax rates fixed amounts and or threholds used in the computation of tax in Malaysia the Malaysia tax tables also include specific notes. Within Malaysia including meals and accomodation. Income tax allowances and deductionsSpecial allowances and deductions available for an employee transport allowance of Rs 1600 per month are exempt from tax for.

Salary bonuses allowancesbenefits This publication is a quick guide containing Malaysian tax information based on current tax laws and practices. Certain allowancesbenefits are exempt from tax. 1 to 9 are required to be declared in Part F of Form EA.

Statutory earnings refer not. However there are exemptions. The hardship allowance is generally between 15 and 35 of employees regular salary.

One of these deductions is the capital allowances in Malaysia.

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Tax Exemptions What Part Of Your Income Is Taxable

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

到底几时要报税 2017年 Income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

0 Comments